Employee Retention Credits (ERC) were initially introduced by the CARES Act which was signed into law spring of 2020. These credits were extended to both the first and second quarters of 2021 with the Consolidated Appropriations Act signed into law December 2020. The credits were recently extended again, to third and fourth quarters of 2021, with the recent passage of the American Rescue Plan Act.

Now that we have a little background on these credits, let’s get into the specifics.

Employee Retention Credit Eligibility

To be eligible to claim ERC, your business must meet one of the following tests:

- Operations were fully or partially suspended due to a government order

- Your business experienced a significant decline in gross receipts

Your business only needs to meet one of these tests to be eligible to claim ERC.

The first test of being fully or partially suspended due to a government order mainly applies to “non-essential” businesses or businesses with capacity restrictions like restaurants, gyms, etc. If your business had the ability to work remotely it most likely will not qualify under this test.

If you qualify under the suspension due to a government order test, only wages paid during the shutdown period potentially qualify for ERC.

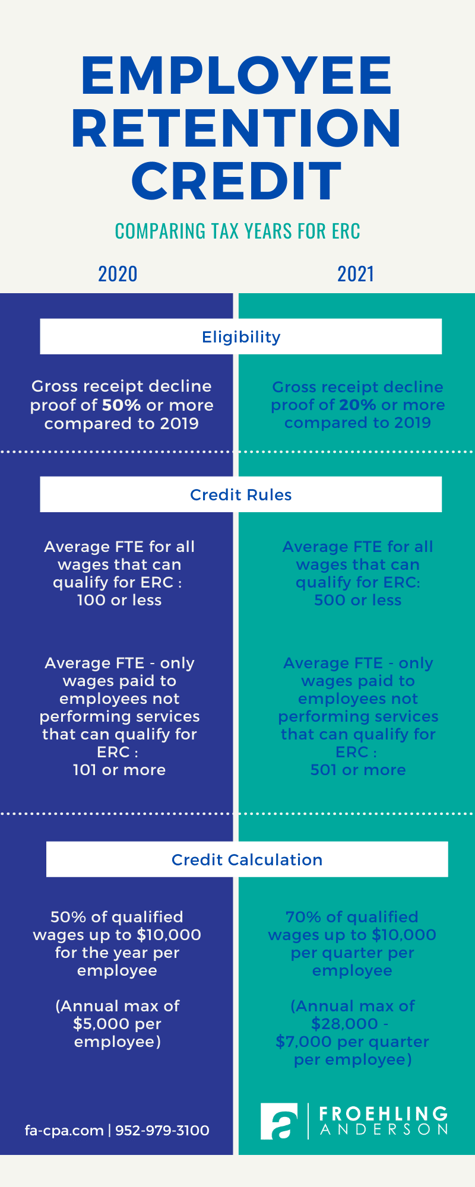

A significant decline in gross receipts is determined by comparing the gross receipts of your current quarter to gross receipts of the same quarter in 2019. For 2020, you need to show a gross receipts decline of 50% or more to be eligible. For 2021, you need to show a decline of 20% or more.

If you qualify under the gross receipts decline test, all wages paid during the quarter can potentially qualify.

Employee Retention Credit Rules

Before getting into the credit calculation there are a few more rules to highlight.

A significant factor in what wages qualify for ERC depends on the number of employees you have. You will need to look at 2019 and determine the average full-time equivalents (FTE) you had for the year.

Now that we know that number, is it below 100 (500 for 2021)? If yes, all wages paid can qualify for ERC. If you have 101 employees or more (501 for 2021) then only wages paid to employees not performing services (ex: furloughed) qualify for ERC.

Another important factor to keep in mind is wages used to claim PPP loan forgiveness are ineligible for this credit. If you obtained a PPP loan in 2020, ERC is still worth investigating even if you already filed for and obtained forgiveness for your PPP loan.

Along those lines any wages used to claim various payroll credits like the expanded paid family and medical leave credits are ineligible for ERC. This rule and the above rule related to PPP loan forgiveness are meant to prevent double dipping on tax benefits.

Final rule to keep in mind is wages paid to owners with greater than 50% ownership and people related to those owners may be ineligible for these credits.

Employee Retention Credit Calculation

After you have determined your business qualifies for ERC you can begin to calculate the credits. The credits are based off “qualified wages,” this is generally taxable wages and excludes any wages that fall under one of the above rules.

The credit calculation itself is very different depending on if we are talking about 2020 or 2021.

For 2020 the credit is 50% of qualified wages up to $10,000. The $10,000 cap is for the entire year, so a maximum credit per employee of $5,000 is available for all of 2020.

For 2021 the credit is 70% of qualified wages up to $10,000. The $10,000 cap is per quarter, so a maximum credit per employee of $7,000 is available for each quarter of 2021.

These credits are payroll tax credits, so they are claimed on your quarterly payroll tax return Form 941. If they were not claimed on the originally filed form you can amend and claim them on a Form 941-X. The credits offset your employer social security and Medicare taxes and any excess is fully refundable.

There are a lot of rules surrounding these credits that need to be considered but if your business is eligible, claiming ERC is a huge benefit during these difficult times.