Froehling Anderson's international association of accounting firms - AGN - gathers opinions of business advisory accountants from across the world. This survey gathered opinions on: how has the mergers and acquisitions market been affected by the global pandemic? Here are the survey results on valuations and the M&A market.

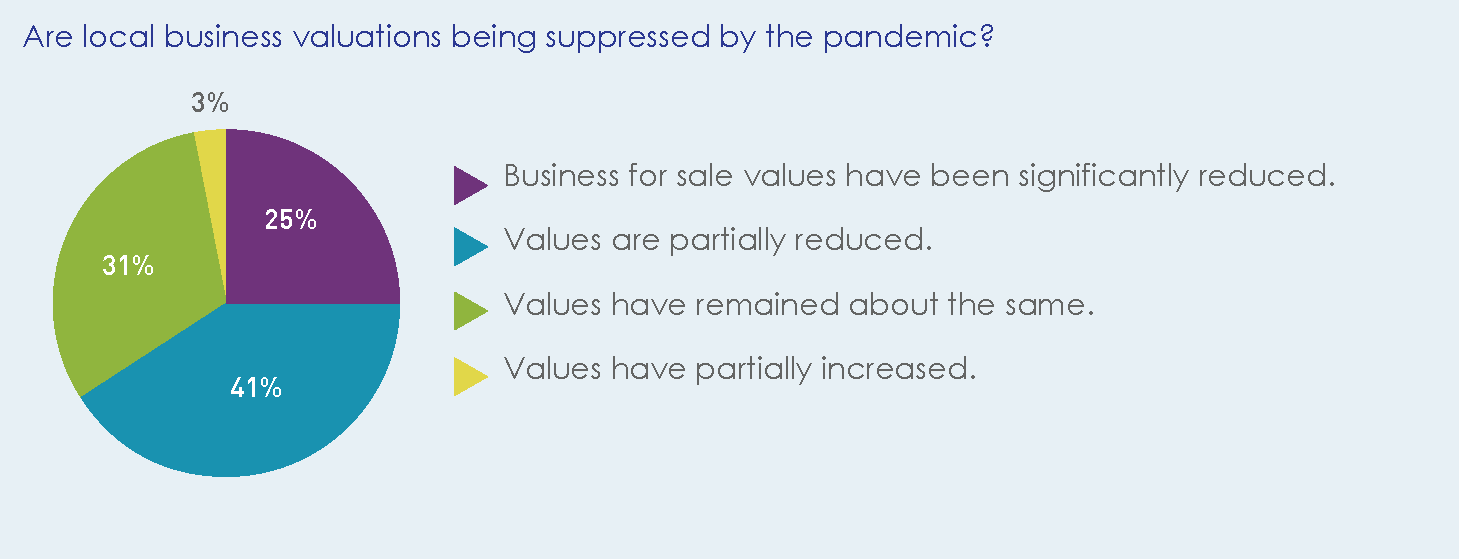

Are local business valuations being suppressed by the COVID-19 pandemic?

The short answer is no. Only 25% of the experts are suggesting ‘significant reduction' in sale values. A very substantial 41% indicating values have only ‘partially’ reduced. How is this possible with a global crisis and one of the worst performing economic situations for several generations? There is anecdotal evidence that deals are being concluded on the more resilient businesses – businesses not just coping but thriving – and these deals are keeping multiples healthy.

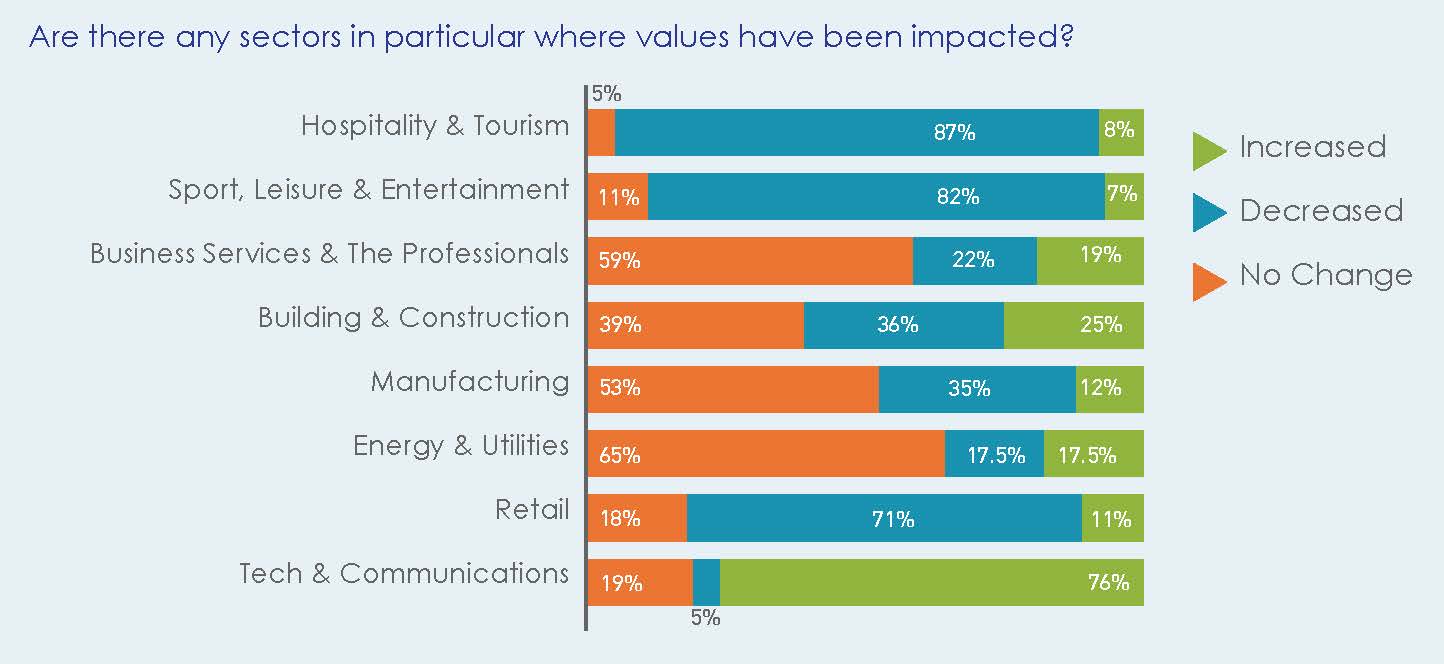

Are there any sectors in particular where values have been impacted?

One doesn’t have to look far to see the actual day to day effects of the pandemic on our economies, but some sectors have been harder hit than others. The blue and green bars tell a dramatic story of pandemic impact. At 86% and 82% respectively, hospitality and tourism, and sport, leisure and entertainment have decreased in value. The severe drop in demand combined with great uncertainty towards recovery will trigger many solvency challenges, with potential for consolidations, restructurings and bankruptcies. Retail is clearly another big victim of lockdown.

Conversely the ‘Tech and Communications’ sectors have boomed. 76% of the panel have seen an increase in the value of these businesses.

Perhaps more interesting than both of these results are the bars colored orange. Very broadly speaking…”no-change” in values for business and professional services, building & construction, manufacturing and energy and utilities. These sectors continued to operate and values remain steady.

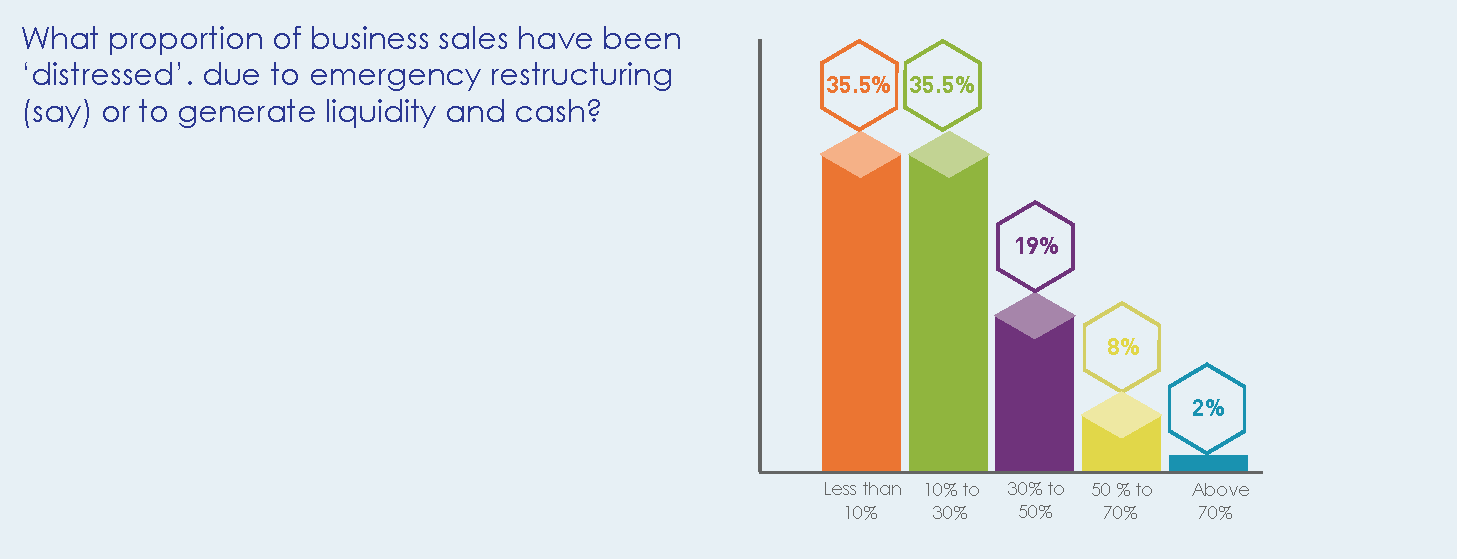

What proportions of business sales have been 'distressed' due to emergency restructuring or to generate liquidity and cash?

Roughly 70% of the panel would say that less than 30% of the sales they have witnessed have been brought about through emergency or distressed circumstances. The panel was asked to predict when their economies would turn around and consequently bring on the surely inevitable rise in bankruptcies and fire sales – as companies outstretch their ability to

generate any more credit. Something like 71% predict anything between 6 to 18 months.

In the coming months, M&A activity will respond differently by sector and geography depending on how severely each is impacted. If you are interested in purchasing in businesses - they may be advantages in purchasing soon.

If you are interested in understanding more about the local M&A market or how to value your company, reach out to us.