For decades, Congress has recognized that companies engaging in research shouldn’t be penalized. Since 1954, businesses have been able to write off R&D expenses in the year they incur them, without having to amortize the spending over time. Yet in 2017, the Tax Cuts and Jobs Act (“TCJA”) put this in jeopardy by including a provision that would eliminate the immediate expensing of R&D costs starting in 2022.

If left unchanged, domestic R&D spending would be amortized over 5 years and foreign R&D spending would be amortized over 15 years. Now that it's 2022, what are the impacts?

➤ Related Content: What TCJA Really Means For Your Business

TCJA Amortization Rule - Will it Stick?

Many R&D experts are optimistic this new regulation won’t stick. When the TCJA was passed, the change to R&D expensing was generally viewed as a maneuver to balance the budget, with the hope that a future Congress would be able to delay or undo this change.

Progress has already been made: the 2021 Build Back Better Act included a provision that would delay the TCJA amortization rule until 2026. Although this act did not become law, it shows that Congress is willing to delay the effective date. Congress recently tried again while passing the CHIPS Act.

For now, we’ll have to wait and see what happens.

➤ Related Content: How new IRS position could impact your R&D refund

What the TCJA Amortization Rule Will Do to Your Tax Liability

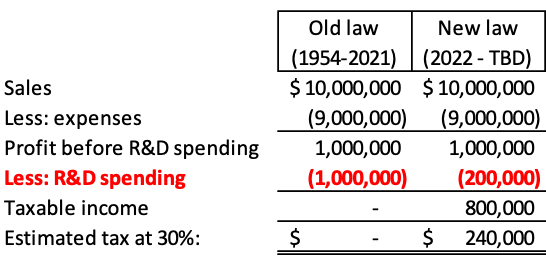

Unfortunately, unless Congress delays or repeals this change to immediate expensing, there would likely be a significant increase in tax liabilities. Here’s an illustration of how this might impact a company with $10 million in sales, and $1 million in R&D spending:

How to Prepare for the TCJA Amortization Rule

If the amortization law stays in place, it could have major impacts on your tax liability—and your business. Consulting with your R&D tax advisor is the best way to create a contingency plan.

At Froehling Anderson, we’ll continue to keep a close eye on this matter. In the meantime, if you have R&D spending or have questions about how the amortization law could affect you, contact us today.

Froehling Anderson is a Minneapolis-based CPA firm and a member of AGN International, a global association of separate and independent accounting and advisory businesses. We provide business consulting, tax, audit and accounting services to a wide variety of industries, including construction, manufacturing & distribution, not-for-profit, professional real estate, and athletes & high net worth individuals.